Mike Huckabee was one of the Republican contenders for the 2016 presidential race.

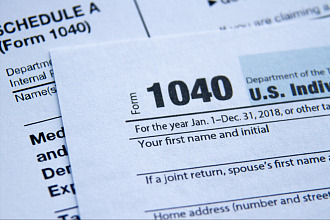

This former Arkansas governor is also known for something even more important in our overweight society. He experienced how it was to continually consume more and more calories. He personally experienced the gigantic portions of Southern cuisine fried in hot grease with extra cornmeal. Like 70 percent of adults in the United States and more than 30 percent of children and teens, Huckabee became overweight. When his weight soared to over 280 pounds and his physician diagnosed him with type 2 diabetes, only then was he willing to shed his bad eating habits for healthier ones.1 Unlike former Governor Huckabee, the average American is facing another weight problem—his/her debt load. According to recent statistics, average households have credit card balances of over $15,000 with a median credit card annual interest rate of 15 percent. The average student loan balance is twice that of the credit card balance at over $30,000 plus an average auto loan debt of $30,000. Unfortunately, in contrast to their heavy debt burden, 60 percent of Americans have a minimum of $500 in a savings account.2

Interestingly, the solution to both obesity and debt can often be dealt with in the same manner. Listed below are three suggestions that can make a difference whether you are facing one of these obstacles or both.

Stop Procrastinating

We can always cook up excuses why today isn’t the right time to lose weight, such as, “my work schedule prohibits me,” or “it’s too cold/hot to begin an exercise program.” The truth is that you will never find the time—you have to make time. No matter what your excuse is or how busy you are, once you start you will find yourself more productive and you’ll have more energy.3

To get started, set a specific date within the next two weeks and write it on your calendar or cell phone day planner. Keep a small workbook in your purse/pocket and faithfully monitor your personal eating habits. Write down the time, place, and content of each meal as well as your feelings at that time, such as joyful, angry, depressed, etc. At the end of the two weeks, look for patterns using the what, where, and why questions and develop a regular eating program that fits your schedule. The final goal is to write down the ideal weight that you would like to have for the rest of your life. Be realistic. It may not be the same weight as on your wedding day or college graduation, but it should be one that makes a good-looking, healthy you.

Procrastinating is also the worst friend of those who are determined to be debt-free. If you are serious, you must decide right now what it is going to take to be free of debt. First step: set a debt-free date. Second step: start tracking where and how money flows through your hands. Remember, it’s not that you don’t have enough dollars and cents; but it’s managing your income and expenses. For the next 14 days, simply track your monetary expenditures. Know exactly what for and where your dollars are going. It will amaze you how clear your spending habits will become after a couple of weeks of authentic recording. Third step: make a list of all your unsecured debt. Getting those credit card balances in black and white will not be a very pleasant experience, but this must be done to know exactly what you owe and then set a goal in months or years to pay down the total amount to zero. In either case—your ideal weight or a debt-free lifestyle—maintaining a positive attitude is the most powerful tool. Don’t think of failure and don’t worry about how you are going to accomplish this undertaking. Remember, by just making a commitment you are halfway to your dream goal.4

Stop Sabotaging Yourself

When it comes to losing weight we are often our own worst enemy. Each day we all talk to ourselves about everything, including food. As we stand at a lunch counter, we frequently say:

“Wow! That looks delectable!”

“This is a delicious and semi-nutritious snack.”

“This is what I need to comfort me after such an upsetting morning.”

Seldom do we say, “This dessert is so good I’m willing to wear a larger size for it,” or “I’d like my triglyceride level to be twice as high at my next check-up.”

To assist you in making the right choice, take an index card and write on one side what your food

devil is saying, such as, “I deserve this one treat,” or “Please, I can’t resist this treat.” Then on the other side, write down what your food angel is countering, such as, “I deserve to be slim” or “I’m not taking orders from a cookie.”5

In the same way, when it comes to being debt-free we often sabotage ourselves. We stand at the clothing counter and convince ourselves that we need this or that outfit.

“Wow! This looks marvelous on me!”

“This will go great with two other outfits in my closet.”

Seldom do we stop and reflect: “This dress (or slacks) looks so good on me, I can afford more on my credit card,” or “It doesn’t matter if my credit card balance is twice as high at the end of this month with a higher interest rate.”

Take an index card and write what your spending devil is saying when you are at the auto mall such as, “I deserve this new automobile,” while your saving angel is countering, “Shine up your current vehicle (a sparkling used car looks like a brand new one).”

Stop Making Excuses

Almost everybody has excuses to justify weight-loss failure. They go like this: “I’ve tried every diet known to man and they just don’t work for me,” or “I’m genetically predisposed.” Here is a classic: “My whole family is big-boned.” Along with these excuses is the habit of stockpiling provisions for those unexpected emergencies such as candy bars or chips. If you really try hard enough, you can lose weight. It may mean missing a meal, cutting back on calories, exercising more, or avoiding sweets, etc.

Those who want to be free of debt can come up with a myriad of excuses for hanging onto their credit cards and getting deeper in debt. “You never know when you will need a credit card,” or “It was on sale for half the price so I felt warranted in purchasing it.” Here is a classic: “I don’t feel safe in carrying cash,” or “It’s not convenient to get cash from my bank, it’s easier to carry a credit card.”

Sometimes it feels like you are swimming upstream because you are so dependent or addicted to the cards but be strong and leave them at home, or put them in a block of ice in your freezer.

Develop a balanced budget and predetermine the amount of every purchase.

Whether you are overweight, over your head in debt, or are experiencing any other out-of-control habits, you need to simply break them into manageable portions and pray for God’s help to develop a strategy for a successful solution.

References:

1“How Arkansas Governor Mike Huckabee Finally Lost Weight,” Bottom Line Tomorrow, September 2005, p. 9.

2Burke Speaker, “Report: Average American Is $225,238 in Debt”, Sep 11, 2013, InvestorPlace.

3“How Arkansas Governor Mike Huckabee Finally Lost Weight,” Bottom Line Tomorrow, September 2005, p. 9.

4“How to Break Out of the Debt Trap,” Debt-Proof Living, January 2008, pp. 10, 11. 5Nancy Stedman, “Six Tricks for Staying Thin,” Health Magazine, p. 60.